Market research firm Infonetics Research released its 1st quarter 2014 (1Q14) Enterprise Unified Communications and Voice Equipment report, which tracks PBX phone systems, voice over IP gateways, unified communications (UC) applications, and IP phones.

Market research firm Infonetics Research released its 1st quarter 2014 (1Q14) Enterprise Unified Communications and Voice Equipment report, which tracks PBX phone systems, voice over IP gateways, unified communications (UC) applications, and IP phones.

ANALYST NOTE

"The enterprise telephony market continues to struggle as businesses hold off new PBX purchases and invest instead in unified communications (UC) applications. Purchase cycles are getting longer, and competitive activity is putting pressure on the market with pricing all over the map," notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research.

ENTERPRISE TELEPHONY AND UC MARKET HIGHLIGHTS

Worldwide PBX revenue (TDM, hybrid, and pure IP) is down 8% in 1Q14 from 1Q13, and down 8% from 4Q13

Although there are pockets of growth in parts of Europe and South America, along with strength down market, none of it is large enough to lift the overall PBX market

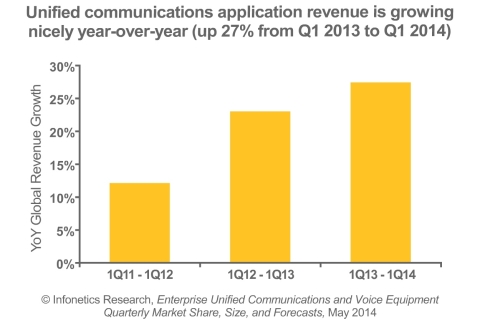

The unified communications (UC) segment is the lone bright spot, racking up a 27% worldwide revenue increase in 1Q14 from the same period a year ago

CALA (the Caribbean and Latin America) is the only region to notch positive year-over-year PBX revenue growth in 1Q14, as economic activity picked up in anticipation of

the World Cup

Cisco, Avaya, and NEC are the PBX market share leaders; Mitel cracked the top 4 as a result of its merger with Aastra

Microsoft, who leads the UC market, is the only vendor in the enterprise telephony segment to post year-over-year revenue growth in 1Q14

ENTERPRISE TELEPHONY AND UC REPORT SYNOPSIS

Infonetics' quarterly enterprise telephony report provides global and regional market size, vendor market share, forecasts through 2018, analysis, and trends for TDM PBXs, hybrid and pure IP PBXs, IP PBXs by system size, VoIP gateways, unified communications, and IP desk phones and softphones. Vendors tracked: Alcatel-Lucent, Audiocodes, Avaya, Cisco, LG Ericsson, Microsoft, Mitel, NEC, Polycom, Samsung, ShoreTel, Toshiba, Unify, Yealink, and others.